Investing in Assistive Technology That Empowers The Disabled.

Why Donate?

Established in 2022, Assistive Kids’ Guru (AKG) Charitable Trust is an Indian NGO that has been working towards the healthy growth and development of the specially-abled kids.

Our work encompasses all fields of development- Mental, Intellectual, Social and Physical for our young stars. We leverage technology to develop tools and services to serve our objectives which are not limited to.

- Developing tests and activities for the mental, physical and intellectual training and growth.

- Developing specialized programs and curriculums suitable to exclusive needs.

- Mentoring the kids and parents along the development curve.

- Interactive therapy sessions with practicing professionals.

- Organizing events and activities to strengthen the resolves and uplift the spirits of all!

We constantly strive to improve, to be able to serve the kids better. There is nothing more uplifting than witnessing our efforts fructify, and the kids improve and develop.

While we are giving it the best that we can, every donation helps us climb the ladder towards betterment.

The donations need not necessarily be monetary. If you are passionate to extend a helping hand by volunteering by any means, Join us!

Kids with special needs lead a life of hardships and we are strongly determined to lift them up. Your generous donation will help them overcome their difficulties and lead a life of dignity.

Every donation counts!

Tax Deduction Concept!

Suppose, an Indian taxpayer has taxable salary of ₹ 5,00,000. He has deposited ₹ 40,000 in Public Provident Fund and ₹ 40,000 in her company’s provident fund. He donates ₹ 45,000 to AKG (Assistive Kids' Guru) Charitable Trust. Presuming he has no other income, his taxable income will be calculated as follows:

After making donation to AKG, his qualifying amount for 80G will be:

Since 42,000 is lower, the qualifying amount will be ₹ 42,000.

Finding out actual deduction

The next question that arises is how much would be the actual deduction? In the case of donations to private trusts, the actual amount of donation would be 50% of the qualifying amount. Therefore, in the example given above, since the donation is made to a private trust, the deduction will be 50% of the qualifying amount i.e. 50% of ₹ 42,000 = ₹ 21,000.

Calculate Your Tax Benefits!

We are working on

Expansion

Our vision is to be a major global charitable organization and we are working extensively to expand our reach among the public.

Identification and Analysis

Disabilities are numerous in types, and so are there effects. To serve the afflicted, identifying and assessing them is one of our main focuses.

Serve for Free!

We strongly believe that our service should not be a privilege for the afflicted, but rather a right. We are strengthening our foundation and aspire to provide charge free service soon!

Frequently Asked Questions

We come across several questions from interested people, finding those that are frequently asked, we are putting them here in case you are wondering about the same. If you don’t find what you’re looking for, please write to us and we’ll be happy to address your query!How will my contribution make a difference?

Your contribution helps us in a variety of ways. It helps sustain our operations, helps us with our research and development of innovative ways to assist the kids. A portion of the contribution goes into our expansion that further increases our capability to serve. Your donation enables us to bring smiles on the faces of the kids with special needs!

Are my donations to AKG Tax exempt?

Yes. We are a registered charitable organization (Regd. No. E/23578/Ahmedabad) and under the section 80G of the Income Tax Act, your donations made to us are exempt from taxation.

How will I get a tax exemption certificate for my donation?

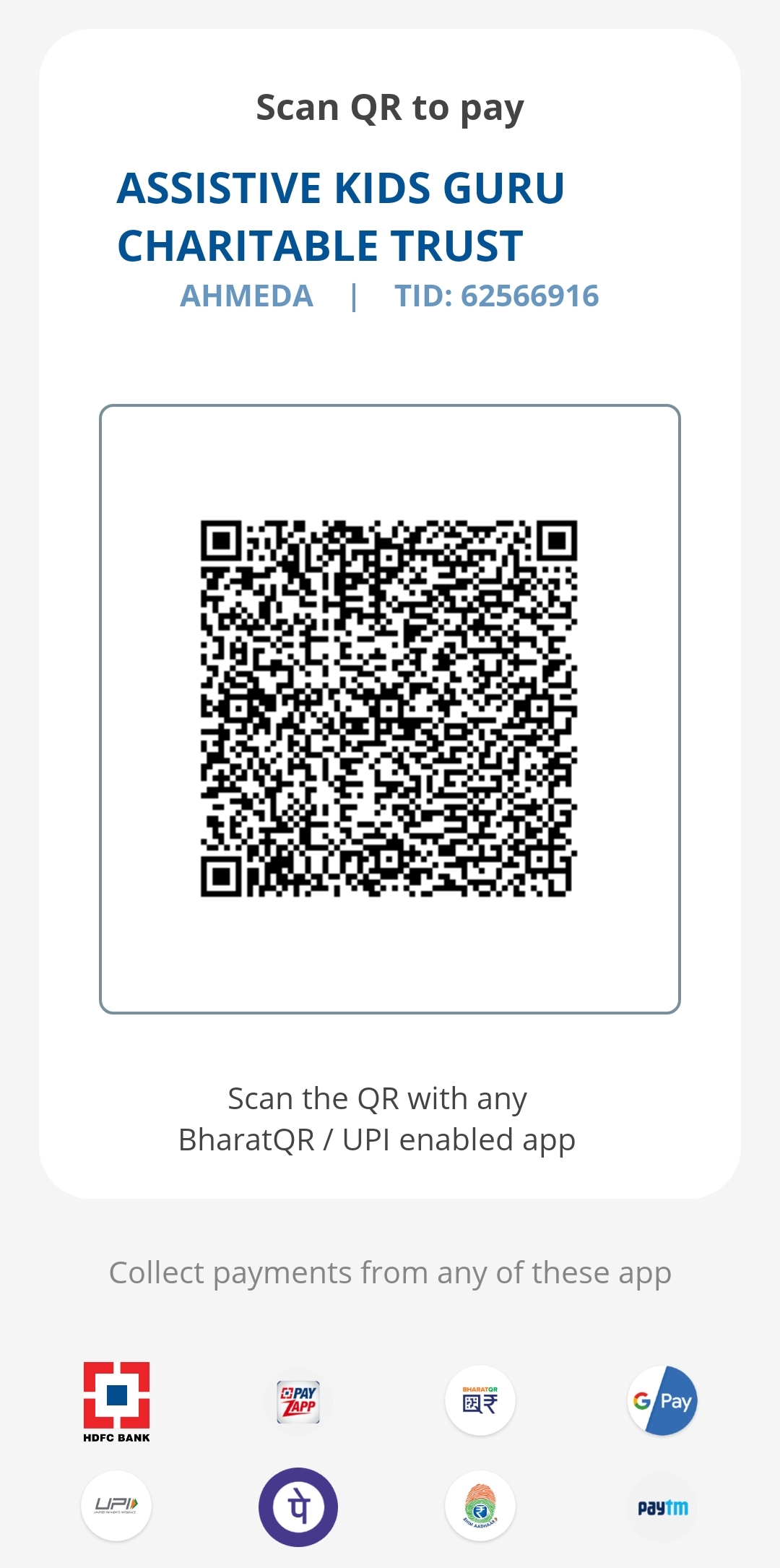

Simply submit the below form and Scan the QR Code to do a payment and will send you donation receipt either by email and on your address once we received the payment – this receipt is eligible for tax exemption and can be shared with the Income Tax authorities.

If you’ve changed your email ID or your address, please write us on hello@assistivekids.guru with the updated details.

Does AKG accept Cash donations?

No, in the interest of transparency and accountability, cash donations are not accepted.

What are the other ways I can donate?

If you'd like to donate offline. You can call us on (+91) 79 4080 1169 or write us on hello@assistivekids.guru and we will guide you.

You can donate to our cause by volunteering for the service of the specially-abled kids. If you wish to lend any asset as a donation that can prove useful for the kids, if you believe that your professional expertise on a subject can be beneficial for them, be it directly or indirectly, your contribution is most welcome. Join us!

What is AKG’s donation refund policy?

Donations received by us are immediately put to use or the welfare of the kids, that therefore cannot be refunded.

Contribute to the effort of empowering kids with special needs by donating to the cause.

Donate

Submit your information after filling the form below, and use the QR code adjacent to the form to donate. The receipt of the payment will be sent to you via email or post. The receipt is eligible for tax exemption and can be shared with the Income Tax Authorities.

- As per Indian Tax Laws, it is mandatory to have full name and address of a contributor else its treated as anonymous donation and is subject to taxation.

- For the time being, donations are accepted only from donors residing in India. We’ll soon start accepting donations from abroad.

- For any further assistance please write to us at hello@assistivekids.guru

- Donations are non-refundable.